Slow Start to Pineapple Imports in 2012

Combined U.S. imports of pineapple products (fresh and frozen, canned, and juice) during the first 4 months of 2012 fell 16 percent in volume from the same period a year ago. Imports were down for all three product categories. On a fresh-weight basis for comparison purposes, imports of pineapple juice during this 4-month period was down 27 percent from the same period last year, fresh pineapple down 14 percent, and canned pineapple down 8 percent. On average, fresh (including frozen) pineapples account for the largest share of total annual import volume with around 40 percent, while pineapple juice and canned pineapples make up almost equal shares of around 30 percent.

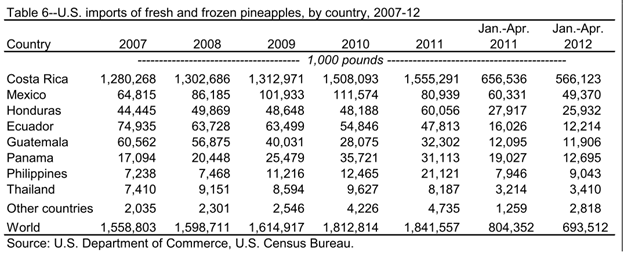

Reduced U.S. imports of fresh pineapples (includes frozen) in 2012, January through April, are impeding fresh pineapple domestic consumption as imports make up a majority of total fresh pineapple supplies in the U.S. market. U.S. imports to date in 2012 from most leading countries supplying fresh pineapples to this market posted volume declines, including Costa Rica—the No. 1 source with over 80 percent of the annual total on average (table 6). Cool weather and heavy rains in late 2011 hampered pineapple production in Costa Rica, causing January-April shipments to the United States to drop 14-percent below the same time last year. Despite this temporary supply disruption, industry sources indicated that with current improved weather, the pineapple crop in Costa Rica will produce ample promotable fruit this spring and summer. Major import suppliers in Latin America also shipped reduced volumes to the United States in January-April 2012. At the same time, imports from key suppliers in Southeast Asia—the Philippines and Thailand—were higher than a year ago.

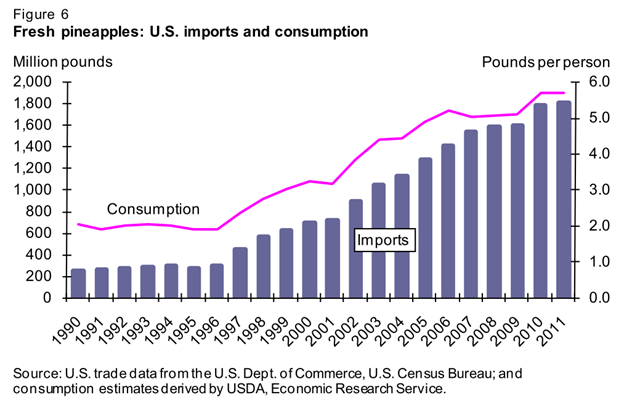

Consecutive year-to-year increases in fresh pineapple imports over the past 16 years helped support the growing demand for fresh pineapples in the United States. Fresh imports increased six folds during this 16-year span, reaching a record 1.8 billion pounds in 2011(fig. 6). Production in Costa Rica recovered from a slow start in 2011 due to cold weather, sending off a total of 1.6 billion pounds to the U.S. market last year, up 3 percent from the previous year and more than making up for big import declines from most of the other major suppliers. Total 2011 imports were up 2 percent from the previous year, providing ample supplies for domestic use. While fluctuating each month throughout the year, U.S. pineapple retail advertised prices in 2011 averaged relatively unchanged from the 2010 average price of $3.00 each, based on AMS data. U.S. fresh pineapple per capita use was estimated at 5.7 pounds in 2011, maintaining the record set the previous year.

(click charts to enlarge)

Should overall imports return to near or above year-ago levels through the remainder of 2012, current domestic demand levels should be sufficiently met, likely leading to reasonable prices to consumers and an increase in domestic fresh pineapple per capita use. For this year through June, U.S. pineapple retail advertised prices have averaged about 1 percent lower than the same period a year ago.

Lower U.S. imports of canned pineapples during the first 4 months of 2012 reflect reduced volumes from top supplying countries, except for Vietnam which registered more than a three-fold increase to date from the same time last year (table 7). The magnitude of declines from major suppliers, Thailand, the Philippines, Indonesia, and Malaysia, ranged from 1 percent to 10 percent, and was much more pronounced from China, down 51 percent. At the same time, juice imports from top Southeast Asian suppliers—the Philippines, Thailand, and Indonesia—were down by as much as 34 percent to 50 percent, outweighing at least a doubling in imports from Costa Rica and Kenya and a very steep rise from Brazil (table 8).

Like in the fresh market, imports mostly supply the demand for these products in the United States. Canned pineapple imports trended slightly up over the last 16 years while pineapple juice imports remained mostly flat, a reflection of domestic demand. Rapid growth in the fresh market is reflected in fresh pineapple imports surpassing those for canned during the past 6 years and those for juice since 2004. Together, pineapples in canned and juice form account for most pineapples available in the United States, on a per capita fresh-weight basis, but Americans are now eating more pineapples in fresh form than in canned and juice separately—a reverse of the situation prior to 6 years ago.

Works Cited

Perez , Agnes, and Kristy Plattner . “Fruit and Tree Nuts Outlook.” USDA United States Department of Agriculture. N.p., n.d. Web. 22 Oct. 2012. <www.ers.usda.gov/media/826893/fts352.pdf>.